The subscription-based model allows businesses to turn transactions into long-term subscribers. With this model, businesses measure the health and performance of their subscribers using a set of key performance indicators (KPIs), which can be a challenge when data lives in multiple systems.

Invoiced now includes analytics and reports to help you understand the health of your recurring revenue business with key subscription metrics right out of the box. You can drill into the underlying subscriber behavior that drives your KPIs like monthly recurring revenue (MRR), customer lifetime value (LTV), churn, and more:

- Charts: Configure, visualize and share your data

- Filtering and segmentation: Monitor the health of individual subscribers or group subscribers by common traits and behaviors

- Customized subscription metrics reports: Use report builder to Intuitively customize reports and save, schedule, and share them

- Multi-currency support: All foreign currency transactions are converted to your base currency for MRR reporting.

- Point-in-time reporting: Understand subscription metrics on any given date.

What’s included?

Invoiced includes the following subscription metric reports out of the box. Many of these reports support segmentation (i.e. month, customer, or plan) and filtering.

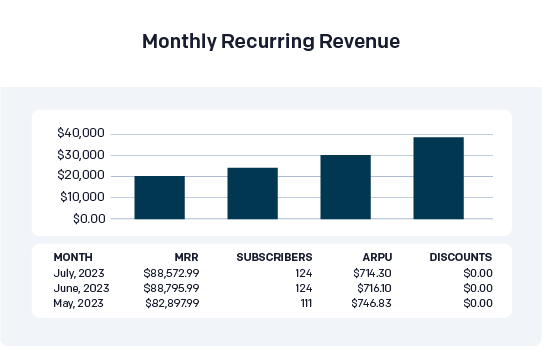

- Monthly Recurring Revenue

- Annual Recurring Revenue

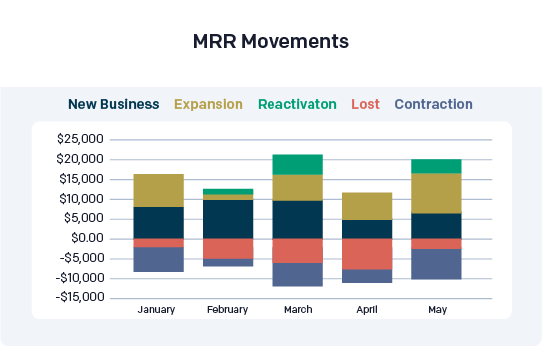

- MRR Movements

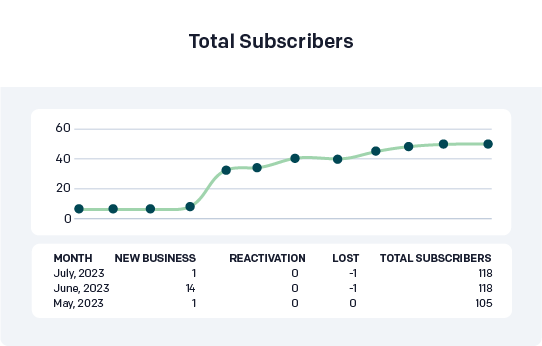

- Total Subscribers

- Churn

- Average Sale Price

- Lifetime Value

- Net Revenue Retention

Custom Reports

With Report Builder, you can build custom MRR reports with your own filtering and segmentation and drill down into the line item level detail behind MRR.

Monthly Recurring Revenue (MRR)

MRR is the basis for tracking recurring revenue. On Invoiced, MRR is derived from recurring line items that were billed. A recurring line item is any line item that has an associated subscription plan and a service period.

MRR Movement

MRR movements capture the types of changes that can happen to your MRR. As your recurring revenue base grows, you would see this reflected in MRR movements. We calculate MRR movements from the line items that are billed to customers.

As your customer’s MRR changes month over month, we break these down into the specific line items that caused the MRR change:

- New Business: All MRR in the first month of a customer’s relationship with you is considered new business.

- Expansion: Expansion occurs when a customer’s MRR increases from the previous month. The previous month’s MRR must be non-zero for it to be considered expansion revenue.

- Contraction: When a customer’s MRR decreases from the previous month but has not churned, then this is considered a contraction. Since this is a decrease in MRR, contraction MRR should be a negative value.

- Lost: Lost MRR is observed when a customer has churned, and their MRR has gone to zero. Since this is a decrease in MRR, lost MRR should be a negative value.

- Reactivation: Reactivation MRR is similar to New Business with one important distinction. We categorize MRR as reactivation if the customer was previously generating MRR and subsequently canceled. Reactivation is the first month of MRR after cancellation.

Subscription metrics are just one piece of the puzzle; automating your A/R and A/P can help clarify the bigger picture. Check out our Product Documentation to learn more about how Invoiced can help improve your top line.