The image of a duck swimming — moving calmly above the water while furiously paddling beneath the surface — serves as a great metaphor for accounts receivable (A/R) operations. To your customers, the invoicing process should be seamless, requiring little effort on their part to settle accounts. But behind the scenes, there’s a lot of work that needs to be done — validating invoices, managing payment details, monitoring for fraud, dunning, and more.

With so many factors and operations to consider and control, accounts receivable management can eat up your accounting staff’s time. But with the right strategies and technology in place — like automation — these complex efforts can become much more manageable, requiring limited human oversight.

In this article, we’ll explore the complexities of the A/R process, what to monitor and optimize to keep it truly running smoothly, and how A/R automation can help streamline your invoicing efforts.

Know you’ve got your accounts receivable processes down pat, but still need faster collections? Check out our A/R automation guide, instead.

What’s involved in an accounts receivable process?

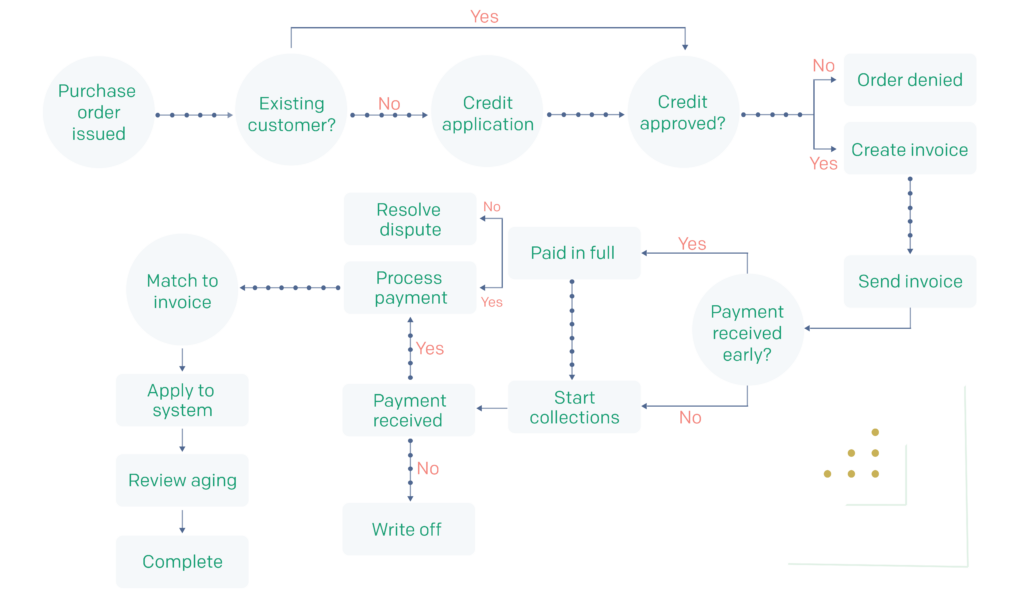

Simply put, the A/R process covers the formal, repeatable actions that a business takes to ensure accurate, timely payment for an order after it has been placed. In general, these functions center around:

- Creating and sending out invoices

- Managing collection efforts

- Processing customer payments

- Recording transactions in accounting and reporting systems

What does the A/R process look like?

Step 1: Ordering – Congrats! Someone wants to buy your product/service.

Your accounts receivable workflow will pretty much always begin with your business accepting a purchase order from a potential customer for a given good or service. Based on the details of this request, you’ll create a corresponding sales order — a binding agreement with the customer that outlines:

- What exactly is being sold

- How much is being ordered and at what price

- When and how the good or service will be delivered

- Whatever payment terms or conditions are tied to the sale

Note: You’ll want to hold off finalizing and sending the sales order until you’ve completed the next step in the process, verifying the creditworthiness of the buyer.

Step 2: Approving – Can you trust the person or business buying your product to actually pay you?

Just because you receive a purchase order doesn’t necessarily mean that you’ll want to fill it. Prior to finalizing your sales order, you should evaluate the risk associated with extending credit to the given customer.

Admittedly, existing customers will require much less scrutiny since they’ll have an existing payment history, but for new buyers, you’ll want to evaluate their financial health as well as overall credit rating. Ideally, you should have an established credit policy in place that clearly outlines the financial thresholds that a business will need to meet to make credit-based purchases.

If the level of risk seems reasonable, finalize and send along your sales order. And for those buyers that seem too risky, consider offering alternate payment options and terms, such as limiting the size of purchases or requiring cash on demand for the first few orders.

Step 3: Invoicing – Time to start the payment process in earnest!

With the sales order finalized, you’ll complete the delivery of the good or service to the customer, subsequently providing them with an invoice requesting payment. And the sooner you can send out the invoice to the buyer, the sooner — and more likely — they are to pay it.

Here’s a list of what your invoice should include to reduce payment friction and errors:

- An invoice number to identify the specific order

- Your business information

- The buyer’s business information

- Details about the product or service delivery

- The total owed

- A clearly designated due date

- Relevant payment terms

- The word “invoice” to distinguish the document from similar records

Invoiced makes creating and sending invoices quick, efficient, and professional, with software that empowers A/R staff to generate customized, branded invoices that can be templated by customer, service, and more — all with advanced, variable payment gateways and terms.

Step 4: Dunning – Collecting payments takes time and effort.

Commonly, the due date for an invoice will be set for 30, 60, or 90 days after the document was created. However, to encourage payments prior to that threshold, you’d be wise to pass along reminder communications at regular intervals that help keep the debt at the front of your customers’ minds.

If the buyer misses the payment due date, you’ll want to keep these regular communications going, gently escalating in intensity as more time passes.

Invoiced’s accounts receivable automation software sends these notifications automatically, saving A/R staff the time and headache of manual dunning efforts. Explore our smart chasing and customer portal offerings to learn more.

Step 5: Resolving – Get out in front of disputes before they happen

In some cases, the customer may disagree with the details included on the invoice, refusing to pay until the issue is addressed. Even worse, they might not communicate this dispute until they are contacted by your A/R staff regarding a late or missing payment. As such, you’ll want a clear dispute reporting and resolution process in place ahead of time — one that can be initiated as soon as an issue is identified.

With potential causes ranging from simple human error to outright fraud, you should conduct a thorough investigation every time to identify the source of the confusion. According to a survey of over 1,000 C-level executives conducted by Wakefield Research and Versapay, human error was the most likely culprit for invoice disputes, followed closely by problems with the delivered goods or services, discrepancies between orders and invoices, and general communication failures.

Step 6: Settling – It’s time to get paid!

Ultimately, your dunning and dispute resolution efforts will either prove successful or fail, meaning the bill will be paid or it won’t.

- If the invoice was paid, then you’ll need to accept and process the payment. There are multiple strategies for handling this step, predominantly varying by which payment types you choose to accept (e.g., paper checks, wire transfers, credit cards). Ideally, you should accept as many options as possible to avoid artificially limiting your potential customer base.

- If the invoice was not paid and you’ve given up on ever receiving payment, you’ll need to record the value as bad debt in both your balance sheet and income statements. Depending on where you are located, the specifics of when you can write off an outstanding invoice as a bad debt will vary. For businesses in the United States, the Internal Revenue Service (IRS) requires that you have strong evidence that the customer will not pay and that you have taken reasonable steps to collect on the debt.

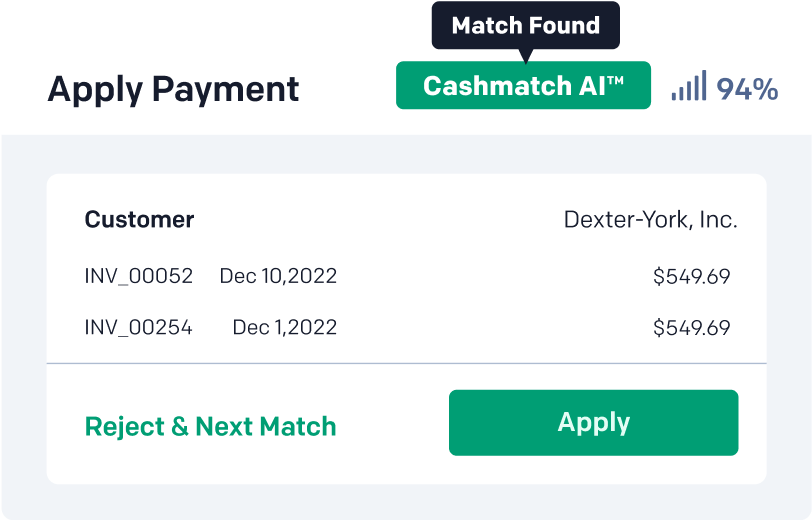

Step 7: Matching – It’s time to get paid accurately!

Assuming a payment was received, you’ll want to ensure that it is credited to the right account. You’ll also need to make sure that you close out the appropriate invoice, which can prove complicated if there is any type of dispute, credit incentive, partial payment, or late payment involved.

Step 8: Reporting – Your A/R state of the union.

When the payment hits your accounts, you’ll need to properly record it in your financial records (e.g., general ledger, balance sheets) as well as your enterprise resource planning (ERP) system.

In aggregate, these individual transactions will be subsequently bundled into regular reports that allow stakeholders and decision-makers to review the overall performance of your company and your accounts receivable.

Invoiced offers powerful, advanced, and pre-built real-time reports, including cash collection forecasting reports and multi-entity reporting. Check out our A/R analytics capabilities to learn more.

Important metrics to drive accounts receivable success

You can have the most efficient procedures and strategies in place, but they only matter if they are being properly followed. And to ensure that things are running smoothly in your accounts receivable payment processing efforts, you should regularly review multiple A/R key performance indicators (KPIs) that deliver insight into what is and isn’t working.

In particular, you should monitor your:

- Accounts receivable turnover (ART): Also known as the debtor’s turnover ratio, your ART identifies the number of times a year your business collects its average accounts receivable. The higher the value, the more efficient your collections efforts are.

- Average days delinquent (ADD): This KPI lets you contrast how many days it takes your accounting staff to close out an invoice against how many days it should take. And by knowing how close your collection efforts are to the ideal, you can more easily identify, react to, and plan for potential bad debt.

- Collections efficiency index (CEI): Another tool to monitor the effectiveness of your collections efforts, your CEI identifies the percentage of your A/R that you collect over a set period of time.

- Customer satisfaction: While not specific to your accounts receivable system, by regularly gauging the overall health of these critical relationships, you can more quickly and easily identify when inaccuracies or inefficiencies in your A/R have a broader impact.

- Days deductions outstanding (DDO): When disputes occur, this KPI measures the average time spent by your staff investigating and resolving these challenges.

- Days sales outstanding (DSO): Your days sales outstanding, in turn, lets you track how quickly your invoices are being paid. A lower figure suggests responsive customers, while a larger number may denote process bottlenecks or other challenges.

- Number of revised invoices: If you’re frequently updating, correcting, or modifying invoices, there’s clearly a problem. By tracking this volume against your overall total, you can more easily identify when there’s a broader issue that needs to be addressed.

Traditional accounts receivable vs modern-day automation

Controlling and monitoring all of these processes, subprocesses, metrics, and reports requires a lot of work. And over the years, two major philosophies have emerged over just who should do this work.

More traditional businesses rely on the hands-on, manual intervention of their staff to keep their invoicing and collections processes running smoothly. While more modern organizations have automated their A/R processes offloading much of these responsibilities onto specialized software that limits direct human involvement.

Traditional, Manual A/R Processes | Step | Automation-Facilitated A/R Processes |

A/R staff individually create and send invoices to customers | Invoicing | Invoices are generated by pulling relevant data directly from ERP systems |

A/R staff contact delinquent customers by phone or email | Dunning | Scheduled, multi-channel touches |

A/R staff routinely learn of disputes only after the customer has missed their payment due date | Resolving | Customers can proactively log into A/R resources to verify invoice details, update payment information, and submit disputes |

A/R staff collect physical checks and coordinate with various payment processors, transcribing relevant information by hand | Settling | Payments are channeled through a self-service portal or a single payment provider that is integrated with ERP systems |

A/R staff locate the appropriate invoices and balance sheets, updating them by hand | Matching | Automation tools leverage AI to match payments and accounts with little human intervention |

A/R staff manually capture data and create regular reports that may take days or weeks to prepare | Reporting | Customizable dashboards offer real-time insight into processes and KPIs |

How automation streamlines the AR process

1. Accelerated payments

With automated workflows in place, you can remove many of the delays common to manual oversight. For example, rather than waiting for the employee responsible for the next step in the process to become available, the system completes the task and routes the invoice to the next stage without lingering. In addition, while human workers can only work on a single invoice at a time, automation platforms can handle multiple records simultaneously.

Even better, as your A/R tasks are completed more quickly, you’ll be sending out invoices in a shorter time frame, which typically translates to faster and more consistent customer payments.

2. Improved collections

Just as your customers are more responsive to accelerated invoicing, they are also more responsive to scheduled reminders, particularly those set to be delivered close to the designated payment due date. And by shifting to multi-channel touches — email, text, phone — you’re much more likely to get the attention of a hard-to-reach customer contact, helping to make sure that your owed payments aren’t overlooked.

3. Satisfied employees

One of the general benefits offered by automation is the offloading of more monotonous, repetitive tasks to the technology. Instead, your employees can focus on more engaging and rewarding challenges.

And by shifting the minds of your A/R staff from the mundane to the strategic, you can leverage that liberated brain power to drive process improvements, identify trends and emerging market opportunities, and deliver more personalized service and support to customers.

4. Hardened security

Fraudsters and other criminal ne’er-do-wells want to steal your assets — and your customers’ money as well, for that matter. But when your A/R processes include built-in validation steps, falsifying invoices or double billing an account becomes much more complicated. Add role-based permissions to the mix, and scammers — both internal and external — will struggle to even access these sensitive systems, let alone exploit them.

5. Increased accuracy

When you minimize the human element from your accounts receivable efforts, you can also minimize the disruption that transcription errors or other human-caused blunders might have on your operations. Instead, critical data is automatically pulled from your other back-office ERP systems, meaning that the relevant inventory, pricing, and payment information will match across documents. And with fewer errors, you’ll spend less time resolving disputes later in the process.

6. Streamlined reporting and auditing

Most automation solutions offer some form of integrated reporting capabilities that can deliver real-time insight into not only your A/R operations but your broader sales and accounting systems as well. In addition, many of these tools provide integrated dashboards that let you monitor common KPIs, and as time passes, you can compile these individual metrics snapshots to identify performance trends.

Even better, armed with these historical records, you can more easily support both internal and external audits of your A/R efforts.

7. Simplified risk management

Alongside the metrics already discussed, you’ll also now have access to a constant stream of payment data that can be drilled down to the individual customer. And with this information in hand, you can more easily make data-driven decisions regarding the payment terms and available credit of existing customers. Given time, you can also build models based on known customers to help predict the likely risk tied to new or potential buyers.

8. Strengthened cash position

Having built centralized, reliable workflows for your invoicing efforts, you’ll be in a much better position to monitor and forecast cash flows. As such, you can more easily make plans for the future or adapt to market changes or opportunities in the moment.

Further, you can leverage this increased visibility to build targeted incentives — such as an early payment discount — to adjust your short- and long-term cash position, offering your business greater financial flexibility.

Transform your accounts receivable process with Invoiced

If all of these benefits sound attractive, you’ll have a hard time finding a better solution to help you achieve them than Invoiced’s Accounts Receivable Automation software.

Offering broad integration support, our technology can readily accommodate all major ERP platforms, pulling data directly from the systems that run your day-to-day business efforts. At the same time, pre-built and customizable dashboards let you capitalize on this more accurate information to identify and resolve process bottlenecks for greater efficiency.

And features like our Smart Chasing function, self-service payment portal, and CashMatch AI algorithm can take over much of the responsibility tied to routine A/R tasks — like dunning, payment processing, and matching — to deliver fast, consistent service while freeing up staff for more strategic efforts.

There’s a lot to benefit from with Invoiced’s accounts receivable automation solutions, and having it demonstrated first-hand by one of our A/R professionals can be extremely useful. Schedule a demo today and see for yourself what our software can do.

Share:

Latest Stories

Here’s what we've been up to recently.