Key Points:

- Accounts receivable (A/R) reflects the total of credit payments owed to your business by your customers and that should be received within the next year.

- Accounts receivable should be recorded on both your general ledger and balance sheet.

- Accounts receivable is considered a liquid asset and a current asset.

- The efficiency of your accounts receivable efforts can be monitored using an A/R aging report or by tracking key accounts receivable metrics and KPIs.

- Accounts receivable management has a direct impact on your cash flow, administrative overhead, and customer loyalty.

Automated accounts receivable

See how Invoiced's automated A/R software can get you paid faster

Accounts receivable definition

Accounts receivable is an accounting term that reflects the funds owed to your business by customers who have already received a good or service but have not yet paid for it. Unless you require advanced payments or deal with cash on delivery (COD) sales only, you must record these credit-based transactions as A/R within your general ledger and corporate balance sheet.

For bookkeeping, consider A/R an asset that is both liquid (can be easily converted to cash) and current (will be resolved through regular business over the next year). As such, the funds can be factored into determining your organization’s working capital or used as collateral for short-term loans.

Colloquially, the term “accounts receivable” is also frequently used to refer to the related departments, personnel, and systems responsible for managing and tracking these unpaid debts.

Accounts receivable vs. accounts payable

Where accounts receivable reflect the funds that need to be paid to your business due to credit-based purchases from your customers, accounts payable reflect the funds that your business needs to pay out to vendors and suppliers for the credit-based purchases that you’ve made. In other words, when you buy on credit, it affects your A/P, and when you sell on credit, it affects your A/R.

For a more nuanced comparison between A/P and A/R, see our article, Accounts Payable vs Accounts Receivable

Accounts receivable processes

Fortunately, the accounts receivable process — at least from a bookkeeping perspective — is relatively straightforward:

- Your customer notifies you of an intent to buy your goods or services on credit through a signed contract or purchase order.

- You deliver the ordered goods or services.

- You provide the customer, either at the time of delivery or shortly thereafter, with an invoice that notes the amount owed and when it is due to be paid (typically within 30 days).

- Typically, invoice entries are listed as a credit to sales revenue on your income statement and a debit to accounts receivable on your balance sheet.

- You wait — hopefully not long — for payment. Ideally, you’ll communicate with your customers at regular intervals to remind them of the outstanding invoice.

- If paid, you record the received funds as a debit to your cash account and a credit to accounts receivable on your balance sheet.

- If not paid, you would note the total as an expense in the bad debt account of your income statement.

Where and what is accounts receivable on a balance sheet?

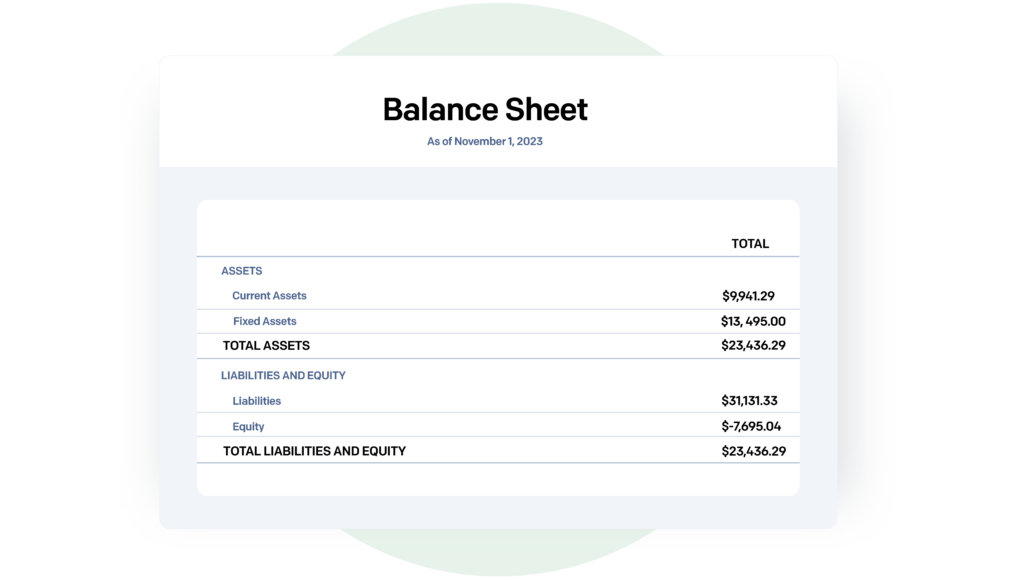

A balance sheet is a financial document that records the assets, liabilities, and shareholder equity of a business at a given moment.

- Assets: Reflect on anything that provides the business an economic benefit or reward.

- Liabilities: Represent funds owed to an outside organization (e.g., vendor, bank).

- Shareholder equity: The monetary value available to shareholders if the business was liquidated and its debts were paid off.

As noted earlier, accounts receivable is an asset, so that you will find your accounts receivable listed in the assets section of your balance sheet and general ledger.

How to record A/R on a balance sheet

Typically, you’ll separate the different types of assets listed on your balance sheet, identifying current assets, fixed assets (e.g., land, buildings, equipment), and other (often intangible) assets.

For example, your balance sheet may look something like:

Accounts receivable aging report

Unfortunately, not all of your customers will pay their debts promptly, meaning you’ll likely have to do some chasing to recover those outstanding funds. This process, known as “dunning,” typically involves sending reminders to these (or soon-to-be delinquent) accounts. To track how well your dunning efforts are going, you should regularly create accounts receivable aging reports.

An A/R aging report (sometimes called an “A/R aging schedule”) records all of the outstanding payments that are still due to your business from your customers. It parses that data by how long the given debts have been owed. At a glance, you can track not only the individual promptness of each of your customers but also gain a thorough understanding of how smoothly your A/R operations are going.

A/R aging report example:

The example above uses 30-day increments to separate the debts, but if you follow an atypical billing cycle or offer non-standard credit options, you may choose an alternate schedule. Further, we provided a simpler format that identifies a company’s accounts receivable on a single row. However, suppose your business sends higher volumes of individual invoices to customers over a month. In that case, you’ll likely choose a more detailed format with additional rows that break out the owed amounts by specific invoice.

Accounts receivable formulas that help measure A/R health

Average accounts receivable

As the name would suggest, average accounts receivable reflects the average value of debts owed to your business by its customers over a given period. In contrast, the A/R figures that you’ll see on a given financial report will exclusively reflect the specific value at the moment the reporting period is ended—offering little insight into the preceding days or weeks.

Admittedly, you likely won’t spend much time evaluating your average accounts receivable independently, but this value is critical for more complex performance metrics like net credit sales and accounts receivable turnover.

Average Accounts Receivable = (Beginning A/R Total + Ending A/R Total) ÷ 2

Accounts receivable turnover ratio

Sometimes referred to as the “debtor’s turnover ratio,” the average accounts receivable turnover (ART) ratio essentially tracks how many times a given company collects a sum of funds equal to its average accounts receivable balance throughout a set period (commonly a year). By monitoring this payout frequency, you can better manage how efficiently your business is collecting revenue—the higher the value, the more productive your A/R processes likely are.

Accounts Receivable Turnover = Net Credit Sales ÷ Average Accounts Receivable

Other important metrics

As you might imagine, there are other critical key performance indicators (KPIs) that you should be monitoring beyond the two primary ones we just outlined. Ideally, you’d also want to track:

- Average collection period

- Average delinquent days (ADD)

- Bad debt to sales

- Collection cost

- Collection Effectiveness Index (CEI)

- Day sales outstanding (DSO)

- Number of revised invoices

- Right party contacted (RPC) rate

What it means to manage your accounts receivable

If your A/R performance metrics are lower than you want, the right strategies and policies can help you boost internal efficiencies while capturing more payments. Consider employing:

- Automation: Unneeded delays can drag out the entire A/R cycle. But with automated workflows that provide validation, authorization, and invoice creation without human effort, you can cut wait times out of your process.

- Due diligence: Financial tides can shift surprisingly fast, so you’ll want to actively monitor the ongoing financial health and credit history of your customers. And if you spot issues, consider limiting available credit or requiring advanced payment.

- Dunning: Don’t leave money on the table. Employ consistent, scheduled, multi-channel touches that gently but encourage payment.

- Early-payment incentives: Don’t forget the carrot when pursuing prompt payments. By offering a percentage discount or other perk for rapid invoice resolution, you can likely capture more interest.

- Formalized credit processes: Establish clear guidelines that dictate how your business determines credit limits, payment terms, and penalties. Then, enforce these policies for all customers.

- Reporting and analytics: To address an issue effectively, it helps to know what is happening. With routine, comprehensive reports that capture a broad range of performance metrics, you can gain the insight to make smarter, better-informed process decisions.

Benefits of well-managed A/R

Build customer loyalty

There are few things more frustrating than struggling to give someone money. On paper, this should be a relatively easy task, but overly complicated or error-prone A/R processes can drag out the entire timeline. Conversely, an efficient, honest, and reliable payment process can improve customer satisfaction and even higher sales.

Cut administrative costs

You’ve got to spend money to collect money. Any measure that your business takes to monitor or capture the revenue from credit-based purchases will require technology and personnel—resources that you have to pay for. But when you can do more with less, you can better recoup some of that outstanding debt with a lower overhead of time, energy, and capital.

Expand your customer pool

Not every business has the cash to pay for purchases when they’re received. Resellers and manufacturers, for example, often need to make credit-based purchases to obtain the raw materials required to generate later profits. But when your A/R processes are lagging—particularly those efforts tied to credit monitoring and evaluation—knowing which potential buyers you can trust to pay may prove challenging and will limit potential sales. Conversely, with the right policies in place, you can recognize safer bets that you might have previously overlooked.

Strengthen your cash position

The most prominent benefit is the ability to secure payments for more of your outstanding debt, which directly relates to a corresponding increase in your cash position and overall revenue. Put simply, it means your business works for free less often.

How accounts receivable automation software can help improve your A/R workflow

Collections: By automating your dunning tasks, you can avoid unnecessary communication delays and ensure that your customers are being contacted consistently and at the right time.

Employee performance: Offload those mind-numbing, repetitive tasks to an automation platform that can never get bored. And without all of this busy work, your workers can instead focus on more strategic—and valuable—efforts, like building stronger customer relationships.

Fraud: The more people involved in your billing and financial efforts, the more risk you add to the entire process. Conversely, automation requires fewer touches to support your billing efforts, limiting the opportunity for underpayments, unauthorized discounts, and customer data theft.

Errors: Despite our best intentions, humans make mistakes. Automation limits the direct involvement of your personnel within your actual A/R activities, eroding the potential for calculation or transcription errors to show up in your billing, meaning your staff will spend a lot less time on dispute management.

Risk management: With automated A/R processes, you’ll receive a steady stream of data and metadata regarding customer habits and payment choices that can be easily collected and reported. Armed with these records, you can begin making data-driven decisions on how and to whom you extend credit.

Automated accounts receivable at Invoiced

With Invoiced’s Accounts Receivable Automation software, you can keep your payment processes moving without breaking the budget

Schedule a demo to observe how our Smart Chasing technology can make your dunning efforts consistent and seamless, spanning email, text, phone, and more. Or explore the software’s integrated self-service customer portal that can standardize and simplify the payment process for both parties. Our invoicing engine can handle the most complex workflows, performing validations, discount management, and dispute resolution without drawing in your staff.