Working capital management reflects your business’s actions to more effectively use its cash and other readily available resources in supporting ongoing operations. By smartly controlling your working capital — the funds required to cover daily expenses — you can better control your overall operating efficiencies while unlocking cash that would otherwise be unavailable or hidden on your balance sheet.

Get the working capital insights you need - fast.

Improve your cash flow and working capital management with A/R automation

What is working capital management?

To be more precise, working capital management refers explicitly to any strategies or processes used by a business to effectively manage, track, and leverage its current assets and liabilities in such a way as to profit the organization. In particular, these efforts look beyond funding day-to-day activities to cover storing sufficient resources for unexpected revenue challenges, capital improvements, and growth. Typically, any efforts to optimize your outgoing payments, invoice processing, cash flow, inventory use, or short-term debt are considered working capital management.

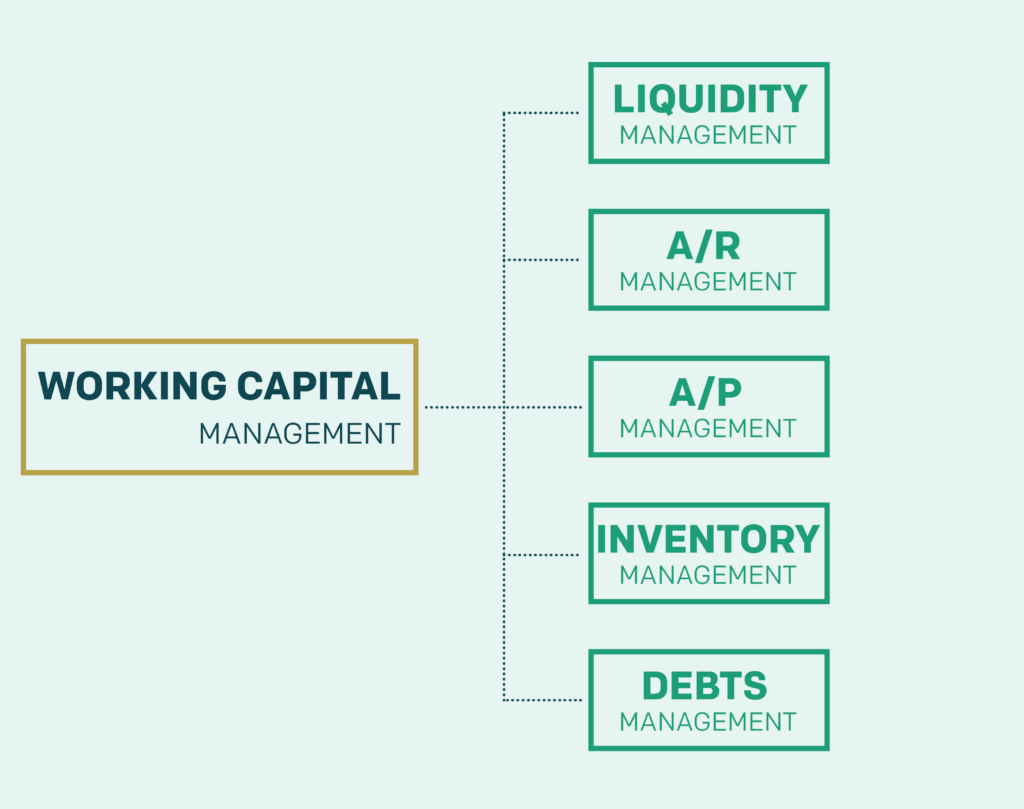

Main components of working capital management

While working capital management is rather comprehensive, covering all optimization efforts related to current assets and liabilities, there are certain areas on your balance sheet where you’ll most likely focus your interest.

1. Accounts payable

Widely considered the liability where you can exert the most control, your accounts payable (A/P) operations and their corresponding management can tremendously impact your cash flow and daily operations. By controlling when you spend your money, you can capitalize on early payment discounts that keep your costs down or hold funds on the books longer to offset short-term financial fluctuations.

2. Accounts receivable

If you’re not operating on a cash-on-delivery model, your accounts receivable (A/R) operations are likely your company’s primary driver of income. Taking measures to manage invoices better, extend credit lines, and ultimately collect on these debts will have an undue impact on how much cash you currently have and will soon have in hand at any given time.

3. Cash or liquidity

To correctly manage your cash flow and overall liquidity, your business should quickly keep sufficient funds available to cover day-to-day operating costs and unexpected needs. Having this surplus will improve your financial standing with vendors and creditors. However, holding too many of your assets in low-yield accounts might indicate that you aren’t sufficiently leveraging this resource to reinvest in your business.

4. Inventory

Covering your finished goods, in-process products, and raw materials, your inventory reflects the full range of potential sales you might make shortly. By properly managing these resources, your business can directly influence the success of its revenue-generating efforts and help increase your working capital. Further, effective management will also help keep warehousing and related costs lower, mitigating some of the ongoing expenses you’ll need to support.

5. Short-term debt

You may use short-term debt to supplement your cash reserves depending on your financial strategy. This method will allow you to leverage your more fluid assets better by keeping less cash in reserve while having sufficient funds available to cover any unplanned costs. Of course, keeping your payments up to date and negotiating for more favorable terms when securing these credit lines will directly impact your working capital.

Types of working capital

Admittedly, when referring to working capital throughout this article, we’ve focused on its most general form: net working capital. And while these two descriptors are often used interchangeably, there are technically a handful of specialized types of working capital that your business may want or need to consider in its financial planning, such as:

- Fluctuating working capital: which only covers the variable (as opposed to fixed) liabilities that a business must consider, such as warehousing costs or utilities

- Gross working capital: which is only concerned with the total amount of assets that an organization has in hand before covering any short-term liabilities

- Net working capital: which reflects the difference between a company’s current assets and its current liabilities

- Permanent working capital: which documents the total amount of resources a business will need to keep available to operate without interruption on an ongoing basis

- Regular working capital: which, as a subset of permanent working capital, focuses exclusively on the funds required for typical day-to-day activities

- Reserve working capital: which, also as a subset of permanent working capital, is only concerned with the reserve funds needed to handle emergencies, seasonal shifts, or unpredictable events

Importance of working capital management

Without sufficient cash, your operations will quickly grind to a halt. Meanwhile, by stockpiling your resources into a massive reserve, you’ll be artificially shackling the growth and improvement of your goods or services. But by balancing these two extremes and keeping an intelligent, reasonable level of cash available while actively reinvesting in your operations, you can better create a healthier, more successful company.

Working capital management ratios

Of course, properly managing your working capital is easier said than done, requiring you to efficiently balance various business efforts without impacting ongoing operations. To accomplish this task efficiently, monitoring some specific metrics that outline overall performance is helpful.

1. Working capital ratio

Also known as the current ratio, this metric is useful in tracking the ongoing health of your business by evaluating the ratio between all current assets and current liabilities. A value lower than 1.0 is considered negative working capital, suggesting that your organization may be experiencing cash flow challenges and unable to cover short-term expenses. And a value over 1.0 reflects positive working capital, meaning you have more than enough current assets to cover your current liabilities.

Commonly, you’ll want to target a value between 1.2 and 2.0, as a value over 2.0 could suggest that you are not effectively leveraging your short-term assets to generate new revenue. Of course, these targets can vary according to several factors, such as your industry, region, or the types of products or services you offer.

Working capital ratio formula:

Working Capital Ratio = The Sum of Current Assets ÷ The Sum of Current Liabilities

2. Collection ratio (DSO)

The collection ratio, commonly identified as days sales outstanding (DSO), specifically focuses on the level of success you’re experiencing in your A/R operations. In more detail, this metric tracks the average number of days your business requires to collect payments for its sales.

To determine your collection ratio or DSO, you’ll first need to choose the timeframe you want to measure, commonly 30 days. Then, you’ll note the net credit sales and accounts receivable collected during that same period.

Collection ratio formula:

Collection Ratio = (Accounts Receivable ÷ Net Credit Sales) x Number of Days

3. Inventory turnover ratio

This ratio tracks how often your business turned over its inventory — relative to your cost of goods sold (COGS) — in a given period. By tracking this metric, you can better monitor how efficiently your organization controls inventory levels. A low score often indicates excessive inventory or anemic sales, suggesting improvements need to be made. While a high score typically implies a healthy business, it can also identify an organization with insufficient inventory to meet current sales.

Please note that targets vary widely depending on several factors, so inventory turnover ratios should only be used to compare very similar companies.

Inventory turnover ratio formula:

Inventory Turnover Ratio = Cost of Goods Sold ÷ Average Value of Inventory

Working capital cycle

Alongside these ratios, another useful metric to consider is the expression of your working capital cycle in days — this cycle being the amount of time that passes between when you spend money to purchase raw materials or inventory and when you convert those materials back to cash by collecting on the corresponding customer purchase.

Working capital cycle formula:

Working Capital Cycle (in days) = Inventory Cycle + Receivable Cycle – Payable Cycle

Where:

- The inventory cycle identifies the time that elapses between your raw material or resource purchase and the corresponding sale of the product or service that uses those materials

- The receivable cycle covers the time needed to receive payment from a customer after a sale

- The payable cycle reflects the gap between your purchase of a raw material or resource and your payment to that supplier

Example of working capital management

First Kind Encounters Ltd. (FKE) is one of the most prominent creators of consumer-focused multi-lens observation posts that are helpful in the tracking and recording of unidentified anomalous phenomena (UAPs). And given the recent stream of declassified documents released by the U.S. government, business was booming.

Despite this success, FKE often felt cash-strapped, with available reserves barely covering day-to-day costs. After analyzing its finances, the business realized it was experiencing rather anemic cash flows and registered a working capital ratio of just 1.01. Further investigation revealed that much of its capital was tied up in outstanding debts held by the wholesalers and retailers that brought its products to consumers.

Choosing a carrot-and-stick approach, FKE restructured its credit terms to enact harsher penalties on late payments. At the same time, the organization also instituted an early payment discount, waiving delivery fees for invoices closed within ten business days of receipt. These measures helped the organization convert more of its outstanding debts into cash, resulting in a new working capital ratio of 1.42.

Discover the benefits of automating your A/R

See why automated A/R is becoming standard practice for business leaders

Working capital management strategies

1. Automate everything

With efficiency being a significant focus for working capital management, there are few actions you can take to accelerate your processes further and cut out waste other than employing automation. Automated process workflows — mainly when used for A/P and A/R — can help reduce cycle times by streamlining operations and eliminating expected wait times. Further, converting tasks previously handled manually (e.g., data transcription, dunning) into touch-free processes can reduce the potential for human error or forgetfulness from complicated efforts.

2. Encourage prompt payment

If your A/R cycle is dragging out, you’ll likely need to take action. Consider offering early-payment discounts to encourage shorter cycle times. Or you might need to update your credit terms to include penalties for late payments.

3. Fight fraud

Easily, the most frustrating loss of working capital can be caused by falling victim to scammers or other criminals out to steal your funds via fraud. Every penny they purloin is one less cent you can use to cover your financial obligations, so you’d be wise to invest in anti-fraud measures focused on protecting your assets. Automation can often help by establishing unified workflows with built-in validation checks verifying the accuracy and legitimacy of payments before they are sent out. You might also consider restricting access to key financial systems and distributing authorization powers across employees — for example, designating two different staff to create new vendor accounts and authorizing outgoing checks, respectively.

4. Keep sufficient reserves

Don’t wait until you are out of stock before reordering a raw material or resource. The unnecessary delay created as you wait for a new shipment can cause slowdowns in your production and delivery efforts, potentially undermining customer relationships and slowing sales.

5. Optimize your inventory

Consider employing just-in-time manufacturing processes. While these efforts typically require investment in comprehensive warehouse management software, reducing and eliminating wait times throughout your production cycle and cutting the overall inventory required to keep operations running smoothly can dramatically reduce your space and storage costs.

6. Pay your bills

The more cooperation you can gather from your suppliers and vendors, the easier it will be to obtain favorable credit terms and adjust your inventory control efforts for speed and efficiency. Missing payment deadlines is one of the easiest ways to damage that business relationship permanently.

Benefits of strong working capital management

By proactively and successfully managing your working capital, you can deliver cost savings and process efficiencies across your business, promoting better financial health and creating the potential for future growth. Commonly, when you enact a sound working capital management strategy, you can expect to:

- Boost profitability: Increasing your assets and limiting your expenses will generate more raw profit, garnering increased flexibility.

- Encourage continuity: No matter how efficiently you prepare, you can’t always avoid the financial pitfalls or market downturns that might affect your business, but by building a reasonable buffer through working capital management, you can better prevent these challenges from unduly influencing your operations.

- Enhance cash flow management: As you exert precise control over when and how you spend your money, you can better dictate how much cash you have available for day-to-day operations and unexpected needs.

- Improve vendor and lender confidence: On-time payments and more enormous cash reserves will typically yield increased cooperation and flexibility with suppliers, letting you capture better interest rates, favorable credit terms, and lower prices.

- Make smarter choices: When you eliminate the guesswork surrounding how much capital you’ll have to work with at any given time, you can similarly reduce the guesswork involved in building forecasts, launching improvements, and growing your business.

Manage working capital with Invoiced

As you take measures to strengthen and better control your cash flow and available working capital, we recommend that you consider the advantages that automation can bring to your financial efforts. In particular, our Accounts Receivable Automation software delivers an intuitive payment portal that reduces errors and offers more choice to your customers, meaning you’ll get paid faster. Our built-in innovative chasing technology can streamline and standardize your dunning efforts, helping to keep outstanding customer debts from slipping through the cracks.

At the same time, schedule a demo of our Accounts Payable Automation software. Automated workflows help ensure that you never miss a payment. And with greater process visibility and built-in invoice verifications, you can remain more confident that your payments are for legitimate charges.No matter which working capital-related processes you want to improve, Invoiced is here to help. To learn more, schedule a demo today.